N.Y. Post: Joe Biden is once again taking a ‘wrecking ball’ to America’s housing market

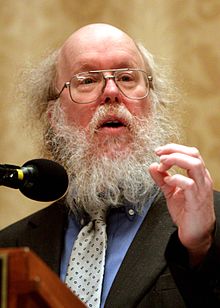

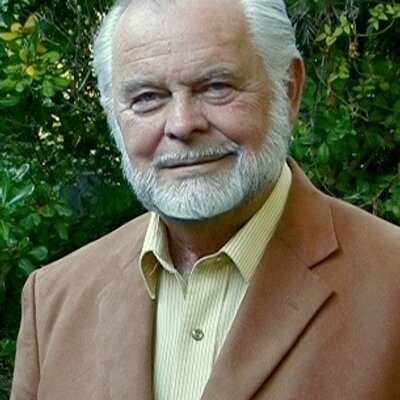

New York Post, March 16, 2024 Joe Biden is once again taking a ‘wrecking ball’ to America’s housing market by James Bovard Would you be willing to save a few hundred dollars on a car purchase if the seller seemed squirrely and didn’t have the title to the car? Unfortunately, you will be on the […]