Biden’s Wrecking Ball Benevolence for Homebuyers

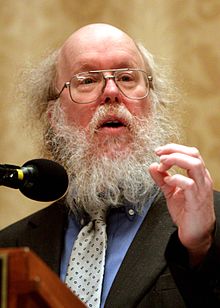

Biden’s Wrecking Ball Benevolence for Homebuyers by James Bovard When did being creditworthy become a federal crime? The Biden administration is intentionally punishing homebuyers with good credit scores to subsidize people with shaky histories of paying their debts. But the latest salvation scheme ignores the sordid history of federal policymakers ravaging homeowners they promised to […]