Paul Volcker’s Long Shadow

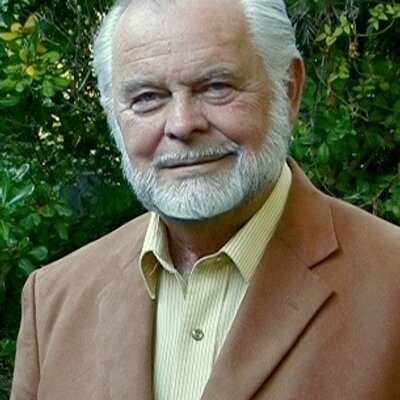

Former Federal Reserve Chairman Alan Greenspan called Paul Volcker “the most effective chairman in the history of the Federal Reserve.” But while Volcker, who passed away Dec. 8 at age 92, probably did have the greatest historical impact of any Fed chairman, his legacy is, at best, controversial. “He restored credibility to the Federal Reserve at […]