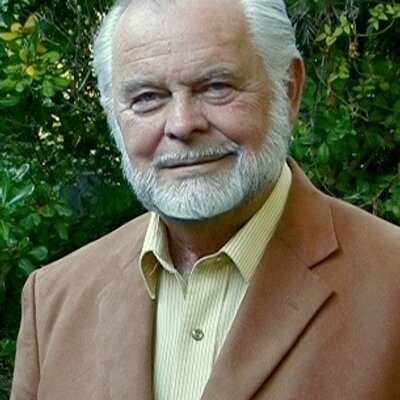

Interview 1516 – Ron Paul on Ending The Fed

[audio mp3="http://www.corbettreport.com/mp3/2020-02-24_Ron_Paul.mp3"][/audio]James Corbett sits down with Ron Paul to discuss the coming end of the Federal Reserve. Dr. Paul reflects on the End The Fed movement, explains the inevitability of the Fed's demise, and talks about what system may come along to take its place.